Many parents often hesitate when filling out a box in the tax return specific to their children.

This is the traditional spring meeting. The annual tax declaration of income comes with the share of worries, fears and anxieties that it can generate among the population.

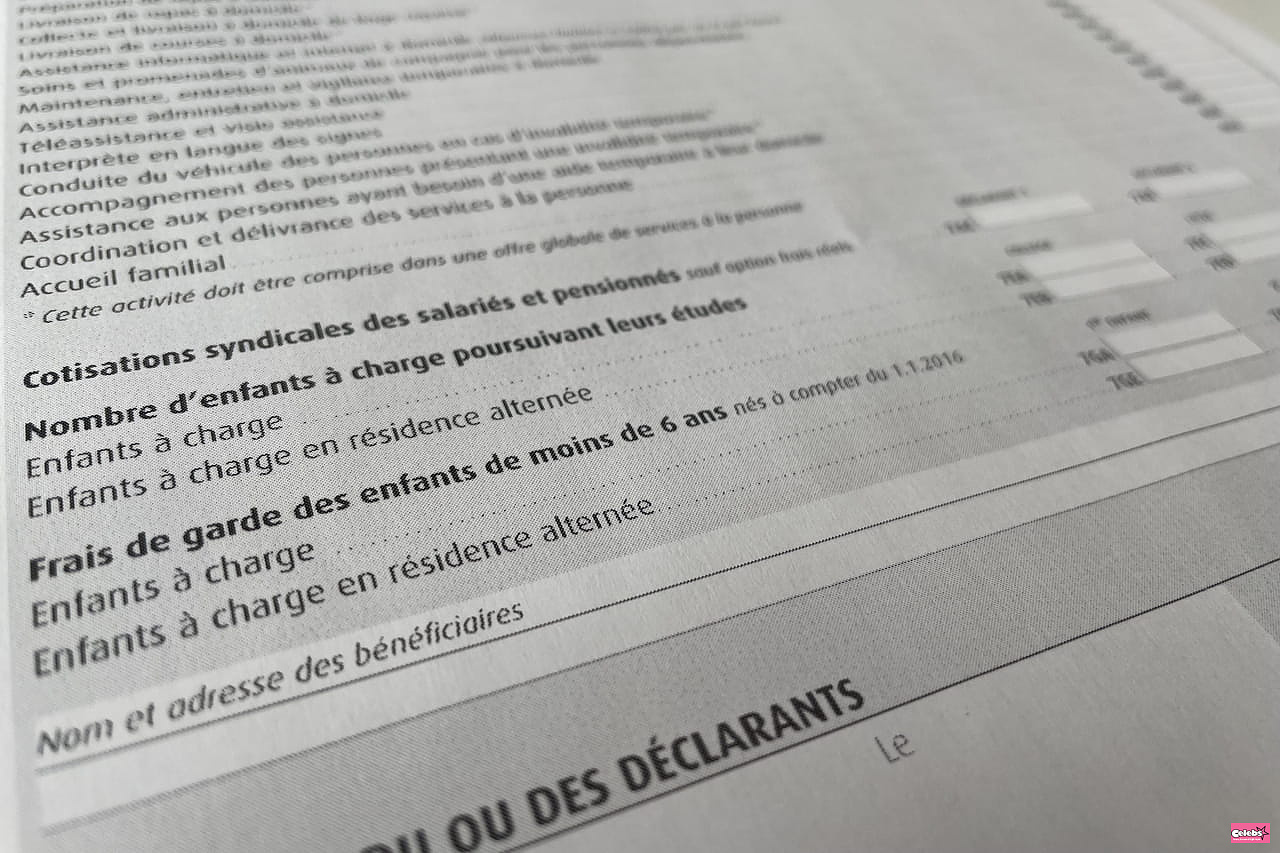

Among all taxpayers, parents are often confused when it comes time to file their returns, especially those with young children. During the first years of their offspring's life, they often resort to a form of care: the crèche, the childminder or even the nanny at home. Provisions which generate significant costs. However, the latter must be indicated for tax purposes and make it possible to reduce the bill paid to the tax administration.

How to properly report them? What costs can be deducted from taxes? In which boxes should I enter these expenses? What about the aid already paid by the State? On the surface, this can quickly be frightening. In reality, you just need to focus on two lines, depending on the guarding method you have chosen.

If your child is in a crèche, you should look at the line “Childcare costs for children under 6 years old” (box 7GA). Here, the taxes indicate to the Internet user that it is simply necessary to insert the total of the costs invoiced annually by the structure, therefore enter the total of the monthly invoices or the annual invoice, the aid from the Caf and, possibly, from your company being directly deducted before paying.

If your child is with a childminder, this is the same box 7GA that concerns you. But this time, a little calculation must be done: you must deduct the monthly aid from the Caf and the aid paid by your company, if you receive them, from the total paid to the “ass-mat”. An example :

If you have your child looked after at your home, the box to fill in is not the same. This is the 7DB, located in the “Personal services: home employment” section, which concerns you. Here you simply need to enter all expenses incurred for the nanny's remuneration.

Finally, in January, taxes probably paid you some money. A document entitled "Amount of the advance of tax reductions and credits" has been sent to you (by mail or directly to your personal tax space), on which an amount is entered.

This must not deduct the amounts noted in the boxes mentioned above. However, it must be marked in box 8EA “Advance on reductions and tax credits received at the start of the year”. The tax authorities then take care of making the total calculations and reducing the amount of tax you will have to pay.

![Euromillions result (FDJ): the draw on Friday May 3 [LIVE]](https://www.celebsnet.com/images/resize/95/334x215/haberler/thumbs/2024/05/_f2969.png)